Global AI in BFSI Ecosystem by Components; by Product, Parts & Devices, by Services & Solutions; by Technology; by Application (Predictive Maintenance/Self Diagnostics, Fraud Reduction, Cybersecurity, Network Security, Network Optimization, Virtual Assistance...); by region

Catogory: ICT & Semiconductor

Published On :

Dec 2019

The Integration of AI in BFSI Ecosystem is providing an edge to the early adopters and is strengthening their

core competencies. The implementation of AI in BFSI ecosystem will improve banking, insurance, and financial services

in the upcoming years, positively impacting fraud mitigation, customer service, credit scores, and investment advisories.

Some of the major advantages of implementing AI in BFSI ecosystem are, tailored customer experience, fraud detection, automated back-end processes,

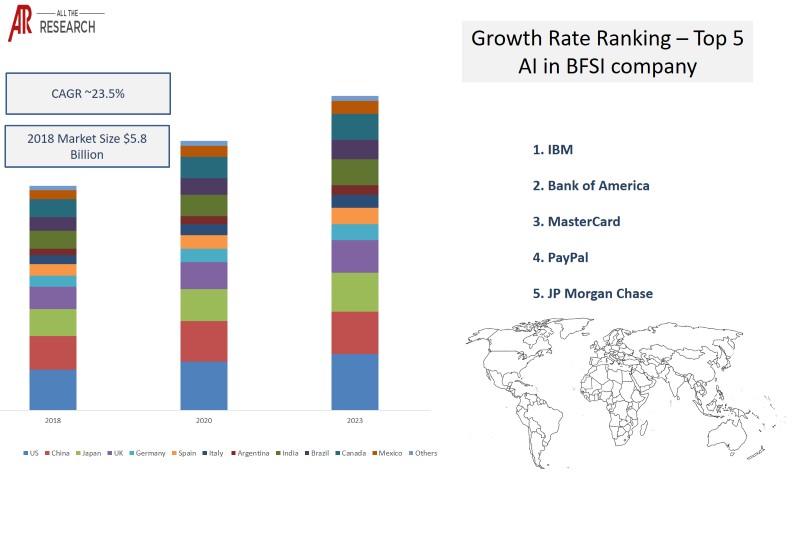

and better turn-around time. According to our estimates, the Global AI in BFSI Ecosystem was valued approximately USD 5.8 Billion in 2018.

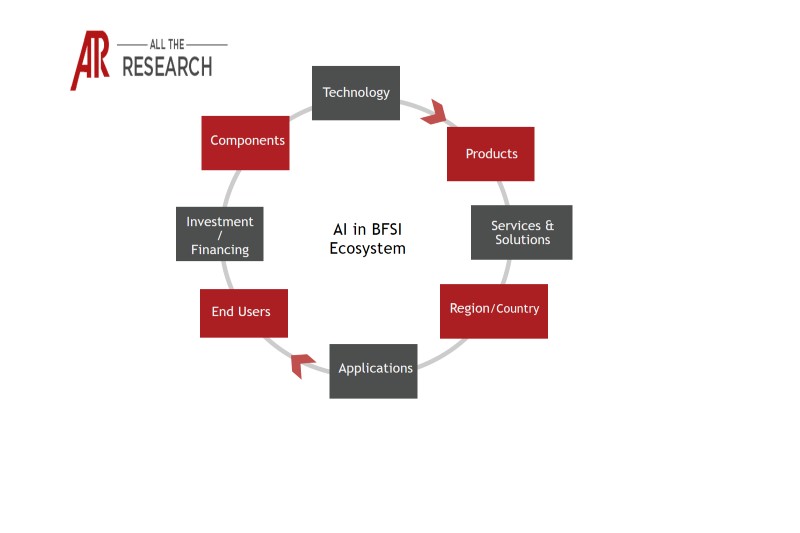

Figure 1:Ecosystem Snapshot: AI in BFSI Ecosystem

Some of the early adopters of chatbot and voicebot in AI in BFSI ecosystem are Bank of America, Commonwealth Bank of Australia, MasterCard, Capital One, and OCBC Bank Singapore. Chatbot can help answer FAQs and basic information. In addition to these, BFSI ecosystem players are outsourcing these technologies,

as in-house development may lead to extra overheads. The Key companies in chatbot and voicebot technology development are Facebook, Amazon, and many other budding startups.

The Bank of America’s Erica, a voicebot, investigates customers’ withdrawal history to measure their spending scenario and inform the current status of

the account if the balance is low. It also suggests solutions such as sending notification and transferring funds. The Commonwealth Bank of Australia’s

Bot executes 200+ banking tasks for customers, such as paying bills, activating cards, sending bank statements, etc. In 2018, the Commonwealth Bank

provided service to 6.2 million NetBank and CommBank app users. Thus creating new opportunities in AI in BFSI sector for real time consumer services.

MasterCard implemented FB Messenger’s chatbot to provide account balance, purchase history, and spending habits of customers.

CapitalOne uses voicebot ENO’s skill to Amazon’s Alexa, allowing customers to use the service on their Alexa app and interact with it regarding their credit

card bills, account balance, etc. ENO is also accessible over smartphone-based chat.

The investment and consulting firm JP Morgan Chase’s COIN bot (Contract Intelligence) implements machine learning techniques to assist the bank’s

lawyers in filtering and analyzing around 12,000 contracts for commercial loan agreements per year. COIN has improved loan-servicing, and it can work

consistently and efficiently. Thus integration of AI in BFSI ecosystem with currently adopted processes of the companies will enhance the company’s

overall business decision making.

In AI in BFSI ecosystem, the insurance sector is looking forward to implement AI based platforms to provide the customized experience, for instance,

ANZ Wealth and the University of Technology in Sydney partnered to build AI-based insurance under-writing and claims processing. This collaboration is

focusing on the use of client behavior modelling, big data, NLP (natural language programming), text mining, and social media predictive analysis.

Japan’s Fukoku Mutual Life Insurance Company has implemented IBM’s Watson, enabling automated processing which reduced 30% of its staff from the payment

assessment department.

AI in BFSI ecosystem includes risk and compliance monitoring companies which are using AI frameworks for audio and video recordings of interactions

between clients and bankers and are trying to identify banking terms that are usually monitored by auditors. For instance, Danske Bank has implemented

an AI Framework which improved its fraud detection rate by 60%. In addition, Paypal has developed a fraud detection engine using Open Source tools,

which works on data mining, machine learning, and human intelligence, and the outcomes helped detect frauds. AI in BFSI ecosystem will enhance the

processing of the transactions, customer’s financial tracking and other critical information required for the decision making.

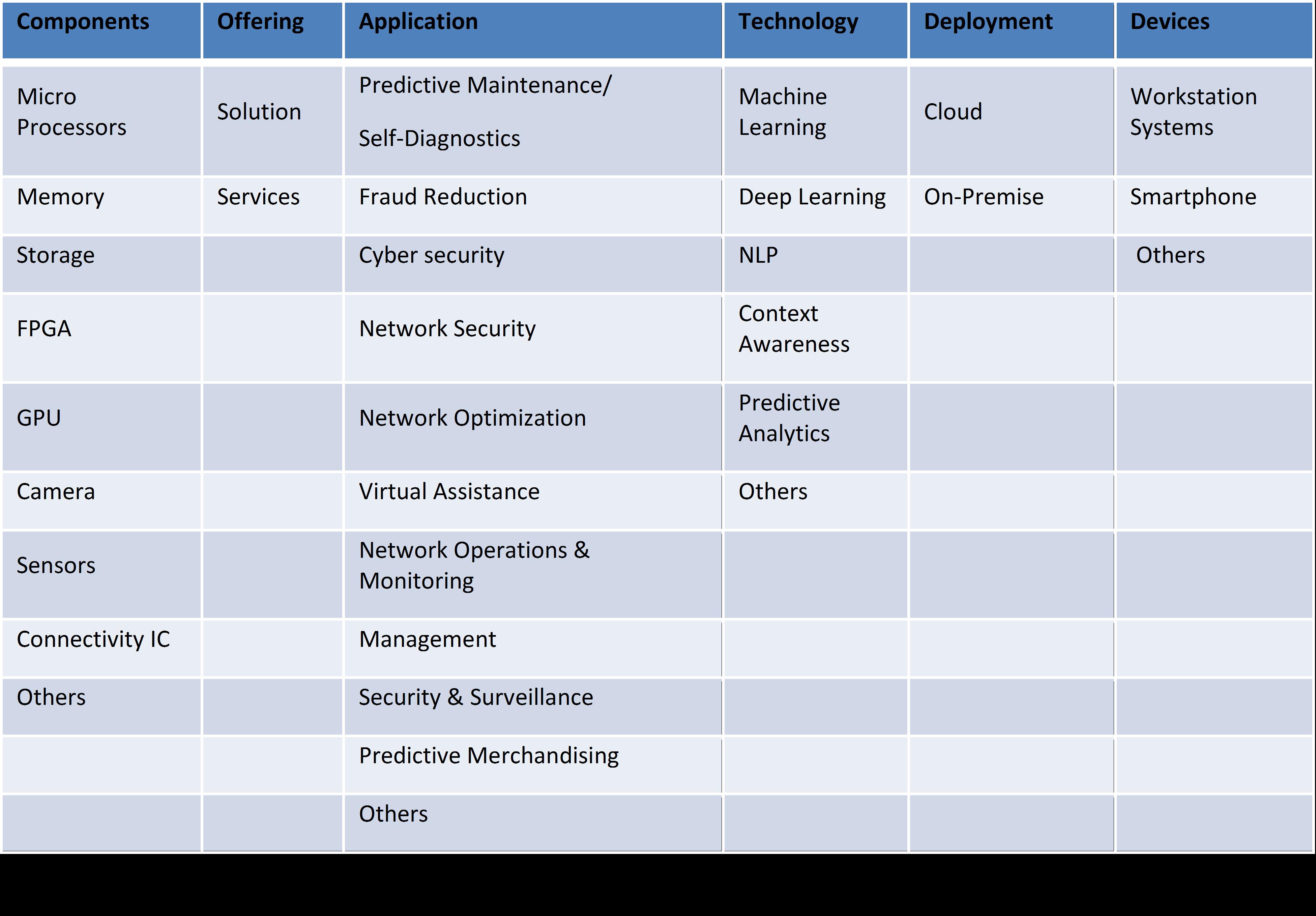

Figure 2:Artificial Intelligence: Segmentation of AI in BFSI Ecosystem

Global AI in BFSI Ecosystem

Globally, AI in BFSI Ecosystem is growing rapidly with the advent of the technology and the availability of the infrastructure. Currently,

North America holds the largest share in the AI in BFSI ecosystem and is expected to dominate the global market in the coming years, followed by Europe

and Asia Pacific. AI in BFSI ecosystem companies are focusing on automation and optimal utilization of resources, as well as working on a

customer-centric approach to improve banking offerings. The digitization in emerging countries will induce the demand for AI in BFSI ecosystem in coming

decade.

Figure 3:Market Statistics Glimpse: AI in BFSI Ecosystem

There are many trends that are having an impact on the AI in BFSI ecosystem forecast. These, when evaluated from a company’s perspective, can drive

growth. Our numerous consulting projects have generated sizeable synergies across all regions and all sizes of companies.

The major players operating in the global AI in BFSI Ecosystem are as follows:

|

Company |

Ecosystem Positioning |

Total Revenue |

Industry |

Region |

|

MasterCard |

Service Provider |

$14.95 Billion |

Information Technology |

Global |

|

IBM |

Service Provider |

$79.60 Billion |

Information Technology |

Global |

|

PayPal |

Service Provider |

$15.45 Billion |

Financial Services |

Global |

|

JP Morgan Chase |

Service Provider |

$109.03 Billion |

Financial Services |

Global |

|

Bank of America |

Service Provider |

$28.15 Billion |

Financial Services |

Global |

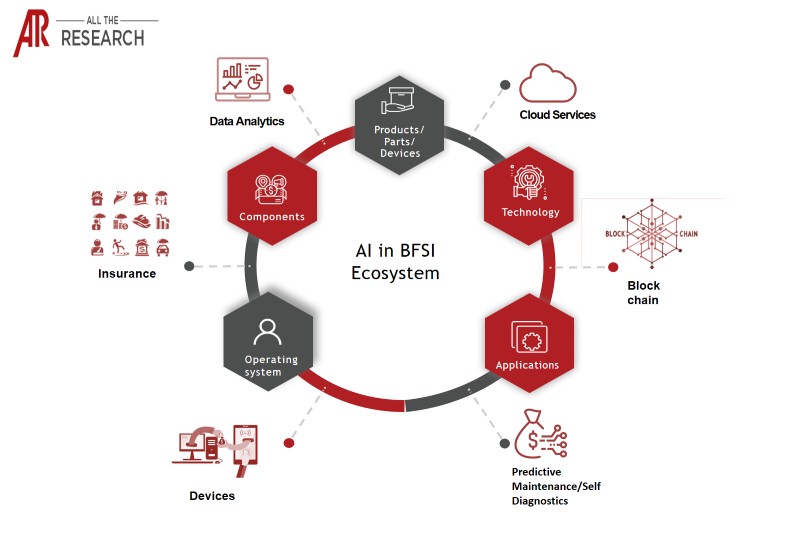

Very few markets have the interconnectivity with other markets like AI. Our Interconnectivity module focuses on the key nodes of heterogeneous markets

in detail. Data analytics, Cloud Computing, and Blockchain markets are some of our key researched markets.

Figure 4:Artificial Intelligence Major Interconnectivities Ecosystem

A Glance on the Global AI in BFSI Ecosystem Trends:

Research methodology:

Ecosystem Report – Table of Content

-

Introduction

- Global Artificial Intelligence in BFSI Market Definition

- Scope of study

- Research Methodology

- Assumptions/ Inferences

-

Sources

- Primary Interviews

-

Secondary Sources

- Key Secondary Webpages

- Whitepapers

- Annual Reports

- Investor/Analyst Presentations

- About FABRIC

- Executive Summary

Ecosystem Positioning

-

Global Artificial Intelligence in BFSI Market Ecosystem Snapshot

-

Global Artificial Intelligence in BFSI Market Segmentation

-

By Components

- Processors

- Memory

- Storage

- FPGA

- ASIC

- Modules

-

By Product, Parts & Devices

- Workstation Systems

- Smart Phone

- Others

-

By Services & Solutions

- Solutions

- Services

-

By Technology

- Machine Learning

- Deep Learning

- NLP

- Context Awareness

- Predictive Analytics

- Others

-

By Application

- Predictive Maintenance/Self Diagnostics

- Fraud Reduction

- Cybersecurity

- Network Security

- Network Optimization

- Virtual Assistance

- Network Operations & Monitoring Management

- Security & Surveillance

- Predictive Merchandising

- Others

-

By Components

- Global Artificial Intelligence in BFSI Market Ecosystem Broad Heads

-

Global Artificial Intelligence in BFSI Market Segmentation

-

Competitive Landscape Mapping by Ecosystem Positioning

- Company by each node

- Vendor Landscaping

- Ecosystem Level Analysis

Trend Analysis

-

Global Artificial Intelligence in BFSI Market Trends

-

Short Term

- Trend Description

- Trend Evaluation

- Trend Outlook

- Trend Company Mapping

- Related Global Artificial Intelligence in BFSI Market Mapping

- Trend Region/Country Mapping

-

Mid Term

- Trend Description

- Trend Evaluation

- Trend Outlook

- Trend Company Mapping

- Related Global Artificial Intelligence in BFSI Market Mapping

- Trend Region/Country Mapping

-

Long Term

- Trend Description

- Trend Evaluation

- Trend Outlook

- Trend Company Mapping

- Related Global Artificial Intelligence in BFSI Market Mapping

- Trend Region/Country Mapping

-

Short Term

Global Artificial Intelligence in BFSI Market Analysis

-

- Regulatory Analysis

Global Artificial Intelligence in BFSI Market Developments

-

-

Global Artificial Intelligence in BFSI Market Events & Rationale

- R&D, Technology and Innovation

- Business & Corporate advancements

- M&A, JVs/Partnerships

- Political, Macro-economic, Regulatory

- Awards & Recognition

- Others

-

Global Artificial Intelligence in BFSI Market Events & Rationale

Global Artificial Intelligence in BFSI Market Sizing, Volume and ASP Analysis & Forecast

-

Global Artificial Intelligence in BFSI Market Sizing & Volume

- Cross-segmentation

- Global Artificial Intelligence in BFSI Market Sizing and Global Artificial Intelligence in BFSI Market Forecast

- Global Artificial Intelligence in BFSI Market Volume Analysis

- Average Selling Price Analysis

- Global Artificial Intelligence in BFSI Market Growth Analysis

Competitive Intelligence

-

Competitive Intelligence

-

Top Industry Players vs Trend Tagging

-

- Importance

- Trend Nature (Positive/ Negative)

- Value

- Interconnectivity for each vendor

-

-

Global Artificial Intelligence in BFSI Market Share Analysis

-

- By Each Node

-

-

Strategies Adopted by Global Artificial Intelligence in BFSI Market participants

-

- Global Artificial Intelligence in BFSI Market Strategies

- New product launch Strategies

- Geographic Expansion Strategies

- Product-line Expansion Strategies

- Operational / Efficiency building Strategies

- Other Strategies

-

-

Top Industry Players vs Trend Tagging

Company Profiles

-

Company Profiles - including the:

-

Microsoft

- Company Fundamentals

- Subsidiaries list

- Share Holding Pattern

- Key Employees and Board of Directors

-

Financial Analysis

- Financial Summary

- Ratio Analysis

- Valuation Metrics

- Product & Services

- Client & Strategies

- Ecosystem Presence

- SWOT

- Trends Mapping

- Analyst Views

- PayPal

- IBM

- Bank Of America

- Amazon

- MasterCard

- JP Morgan Chase

- Citi Group

- Danske Bank

- Capital One

- Commonwealth Bank of Australia

- OCBC Bank Singapore

- PNC

- Zestfinance

- Scienaptic systems

- Underwrite.AI

- Kensho

- Ayasdi

-

Microsoft

Customizations

-

Ask for Customization

- Sensitivity Analysis

- TAM SAM SOM Analysis

- Other Customization

-

Appendix

- Sources

- Assumptions

- Contact

Tables and Figures is not available